Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

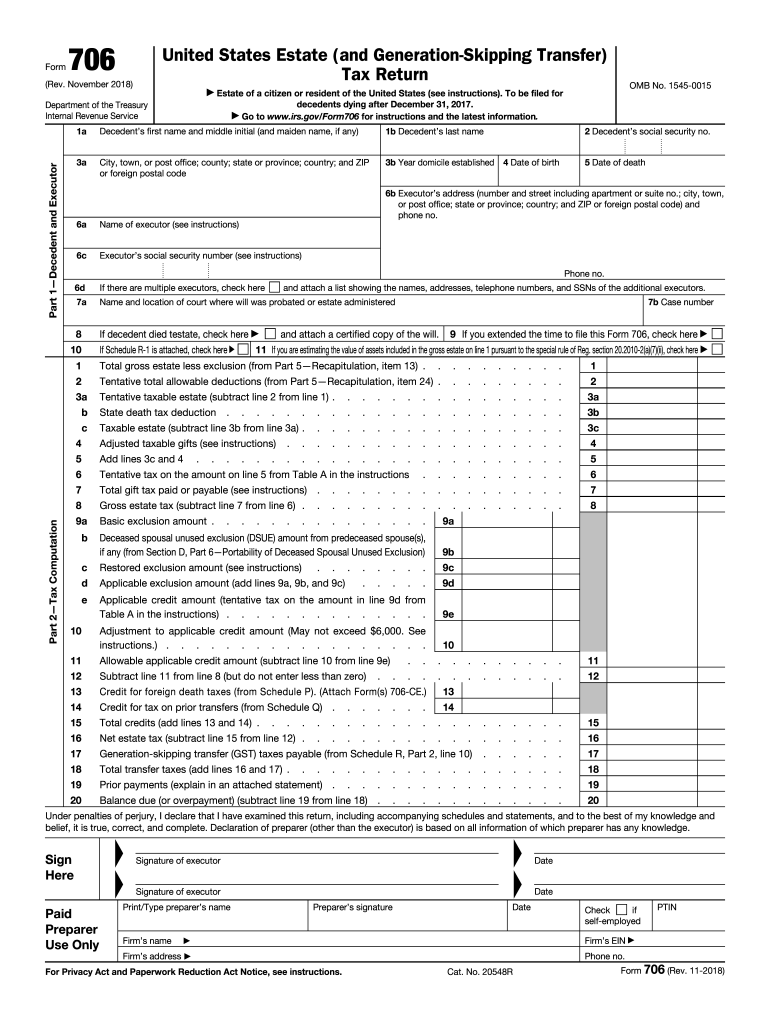

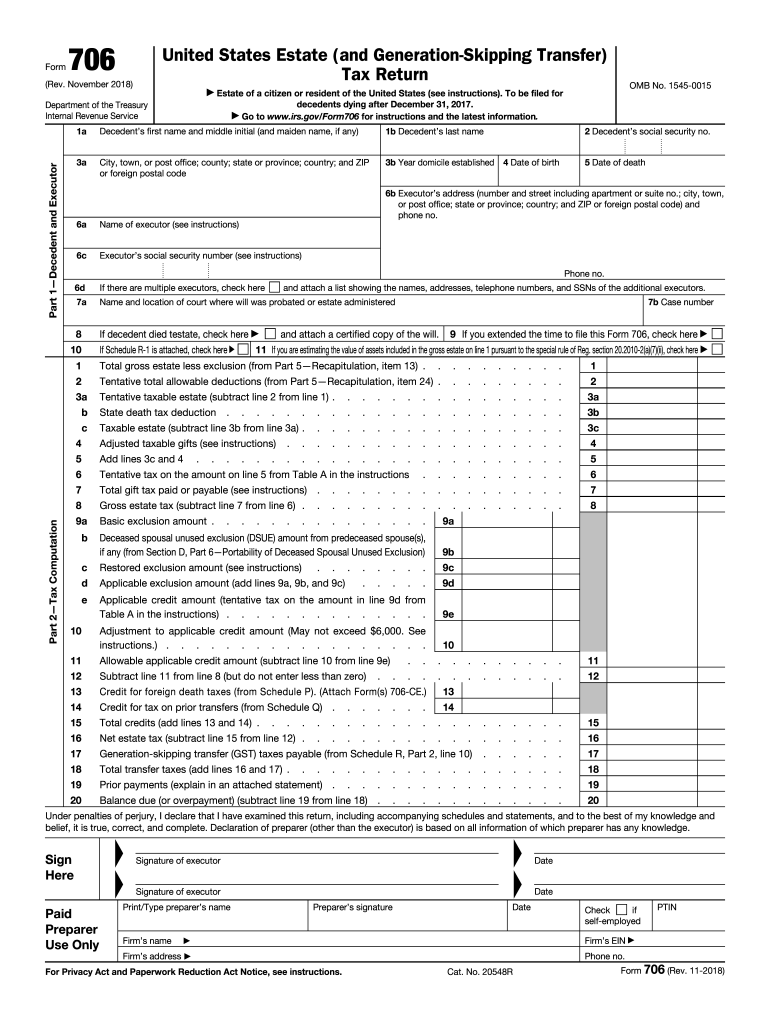

IRS Form 706 is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is used to report a person's estate and calculate the amount of estate tax owed. It must be filed if the gross estate of a decedent exceeds the applicable exclusion amount.

Who is required to file irs form 706?

The Internal Revenue Service (IRS) requires individuals to file a Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, if the taxable estate of a decedent exceeds the applicable exclusion amount. Generally, executors of the estate of a decedent are responsible for filing this form.

How to fill out irs form 706?

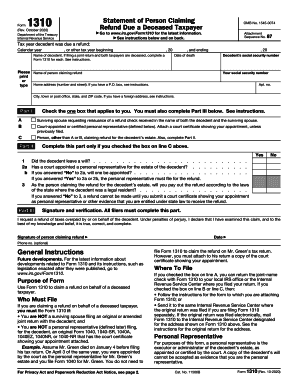

The IRS Form 706 is an estate tax return used to report the value of someone's estate. The form is completed by the executor of the estate.

The form requires information about the deceased including their date of death, Social Security number, and marital status. The form also requires information about the assets and debts of the estate. This includes a list of the assets, their fair market value, and the amount of the debt.

The form also requires information about any federal estate taxes that have been paid, any gift taxes paid, and any applicable credits and deductions.

Once the form is completed, it should be signed and dated by the executor of the estate. The form should then be mailed to the address provided on the form.

What is the purpose of irs form 706?

IRS Form 706 is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is used to calculate the estate tax liability of a deceased person's estate and provide information regarding the distribution of assets. It must be filed by the executor of the estate.

What information must be reported on irs form 706?

The IRS Form 706 must include information about the deceased's property, estate taxes due, and the executor's name, address, and signature. Additionally, the Form 706 includes information about the deceased's marital status, the total value of the estate, and any bequests, transfers, or gifts made during the decedent's lifetime. It also requires information about trust funds, life insurance, retirement accounts, and other assets. Finally, the Form 706 asks for information about taxes paid, deductions taken, and any other expenses related to the estate.

When is the deadline to file irs form 706 in 2023?

The deadline to file IRS Form 706 in 2023 is April 15, 2024.

What is the penalty for the late filing of irs form 706?

The penalty for the late filing of IRS Form 706, which is used to report and calculate estate taxes, can vary depending on the circumstances. Generally, if the Form 706 is filed after the due date (including extensions), a penalty of 5% of the unpaid tax amount is assessed, per month or part of a month that the return is late. This penalty can accumulate up to a maximum of 25% of the unpaid tax.

In certain cases, if the IRS determines that the late filing was due to intentional disregard or fraud, the penalty increases to 15% per month. However, if there is a reasonable cause for the late filing and can be proven to the IRS, they may waive the penalties. It is important to consult with a tax professional or the IRS directly for specific details and circumstances related to your situation.

How can I manage my irs form 706 directly from Gmail?

form 706 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make edits in fillable form 706 1999 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your form 706 1999, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out schedule a on reverside side of form 706 in year 2001 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign form 706 july 1999 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.