Time and cost savings

- Quick and easy setup

- Process automation

- Workload reduction

- Easy integration

VeriFace is a comprehensive remote identity verification service that streamlines the customers onboarding process, ensures full compliance and reduces numbers of frauds.

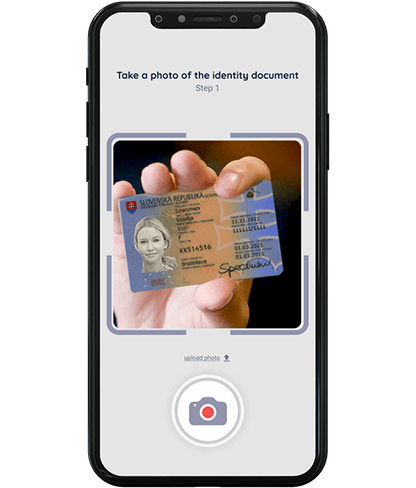

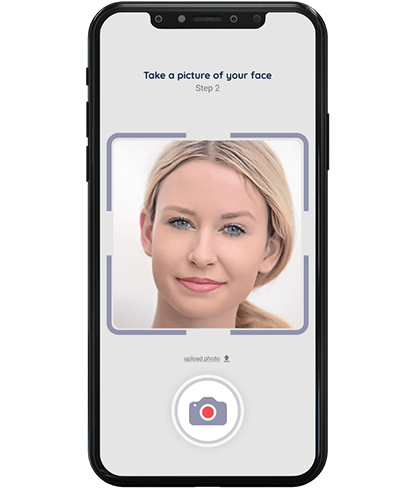

Verify your customers' identities in seconds in 2 simple steps:

Take a picture of your ID from both sides with your smartphone camera or webcam

Take a picture of your face with your smartphone camera or webcam

You have been successfully verified, quickly and safely using artificial intelligence

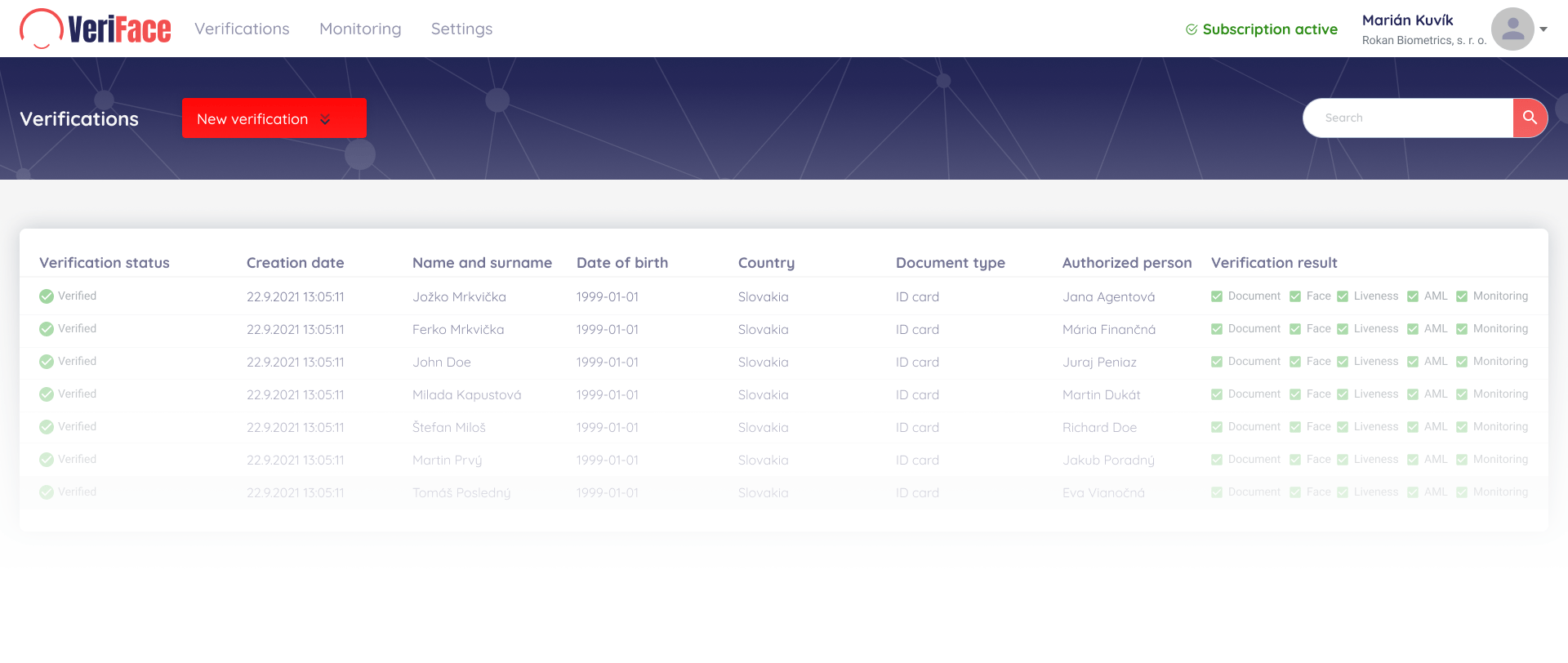

Access easily, validate your customer data, and collaborate with your team members.

Identity verification results and verification status overview

Secure storage of data about

customers in accordance with GDPR

Regular monitoring and continuous updating of data

Our user-friendly 2-step identity verification process helps simply, quickly, reliably, and most importantly, securely onboard new customers.

Roland Kraslan, founder and CEO of Rokan Biometrics, says that working with personal data, its verification and assurance, it is not just a matter of complying with legislation. It is mainly about feeling safe, costs and time saving of manual data management and data verification, adds Tomasz Bieli艌ski, CTO of the company.

Harnessing the power of VeriFace鈥檚 online identity verification platform offers your company the chance to deploy biometric facial recognition and strengthen your customer identity verification processes.

The Know Your Customer and Identity Verification processes are designed to help reduce the risks of illegal activity by identifying and verifying the identification of players, while suspicious persons and potentially high-risk players may be monitored or banned.

A wide range of setup and integration options that adapt to your UI/UX interface.

Ready-made solutions for automated customer onboarding with quick setup and easy configuration.

Highly customizable SDK for iOS and Android built on native technologies for seamless integration.

Send a link to customers and check the verification results immediately in the Administrator portal or be informed about them via notifications or Webhook.

Integrate our KYC solutions and customer identity verification into your platform, collect the necessary data, and get API verification results.

哆哆女性网武脉官能晁姓女孩起名办公家具公司起名大全宜宾网站建设费用商丘到云南专线参观文昌航天城观后感萨特鼠年的孩子起名百度seo视频教程杨姓女孩起名100分柜中美人免费电视剧好听陈姓起名字建设网站项目计划书男宝 起名冰糖炖雪梨电视剧免费播放紫微斗数命宫推算方法公司起名与水有关的专业互联网营销推广周易算失物营销品牌推广公司学seo的好处营销推广跟化州市合江镇新闻属鼠的人起名宜忌用字注册网站设计营销广告推广公司女孩起名字姓刘大全免费起名字甚么讲究用高起名字,女孩要塞报告淀粉肠小王子日销售额涨超10倍罗斯否认插足凯特王妃婚姻不负春光新的一天从800个哈欠开始有个姐真把千机伞做出来了国产伟哥去年销售近13亿充个话费竟沦为间接洗钱工具重庆警方辟谣“男子杀人焚尸”男子给前妻转账 现任妻子起诉要回春分繁花正当时呼北高速交通事故已致14人死亡杨洋拄拐现身医院月嫂回应掌掴婴儿是在赶虫子男孩疑遭霸凌 家长讨说法被踢出群因自嘲式简历走红的教授更新简介网友建议重庆地铁不准乘客携带菜筐清明节放假3天调休1天郑州一火锅店爆改成麻辣烫店19岁小伙救下5人后溺亡 多方发声两大学生合买彩票中奖一人不认账张家界的山上“长”满了韩国人?单亲妈妈陷入热恋 14岁儿子报警#春分立蛋大挑战#青海通报栏杆断裂小学生跌落住进ICU代拍被何赛飞拿着魔杖追着打315晚会后胖东来又人满为患了当地回应沈阳致3死车祸车主疑毒驾武汉大学樱花即将进入盛花期张立群任西安交通大学校长为江西彩礼“减负”的“试婚人”网友洛杉矶偶遇贾玲倪萍分享减重40斤方法男孩8年未见母亲被告知被遗忘小米汽车超级工厂正式揭幕周杰伦一审败诉网易特朗普谈“凯特王妃P图照”考生莫言也上北大硕士复试名单了妈妈回应孩子在校撞护栏坠楼恒大被罚41.75亿到底怎么缴男子持台球杆殴打2名女店员被抓校方回应护栏损坏小学生课间坠楼外国人感慨凌晨的中国很安全火箭最近9战8胜1负王树国3次鞠躬告别西交大师生房客欠租失踪 房东直发愁萧美琴窜访捷克 外交部回应山西省委原副书记商黎光被逮捕阿根廷将发行1万与2万面值的纸币英国王室又一合照被质疑P图男子被猫抓伤后确诊“猫抓病”